Family Office Started

Family Office Started

Residential Costa Caparica – Social Housing

Founded in 1947, the Paz Family Office started their property development journey through the expertise of the Principal, he started as a planning professional in the local community area but adapted and increased his skills to be a civil engineer and by the late 1950’s he had become a developer and investor.

Urban Development

Urban Development

Urban Planning Commercial and Residential – Capuchos

Over the decade the Family supported the development of a number of neighbourhoods in and around the Costa Caparica and Capuchos areas being mainly involved in the construction of both multi-family residentials as well as individual large developments covering the entire district. The continued to support the local community in this way for the next 20 years.

Diversification of Portfolio

Diversification of Portfolio

At the start of the new millennium, the Families made the decision to start diversifying from Real Estate into other investment strategies with Family focusing their interests into starting and growing one the markets’ leading waste management and agri-fertiliser company.

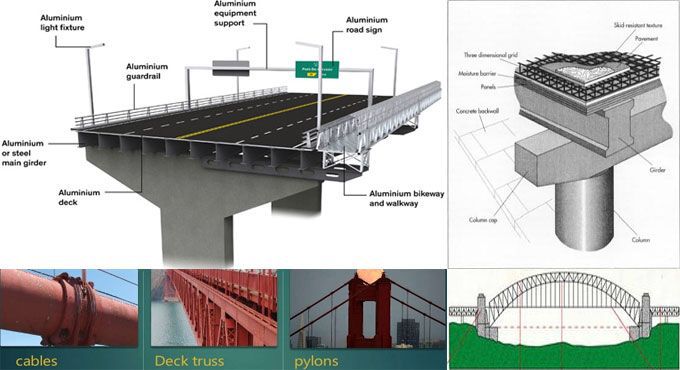

Transportation Infrastructure and Engineering

Transportation Infrastructure and Engineering

The family having spent many years in the civil engineering sphere, widening their scope of development into the bridges, roads and transportation infrastructure including structural build, concrete integrity and complex steel engineering.

Commercial & Residential Expansion

Commercial & Residential Expansion

Albufeira, Portugal – 10 Residential Units

One of the Family’s branch, continued their expansion of commercial and residential projects were expanded in 2002 to 2005 in Charneca da Capital and Almada/Seixal districts.

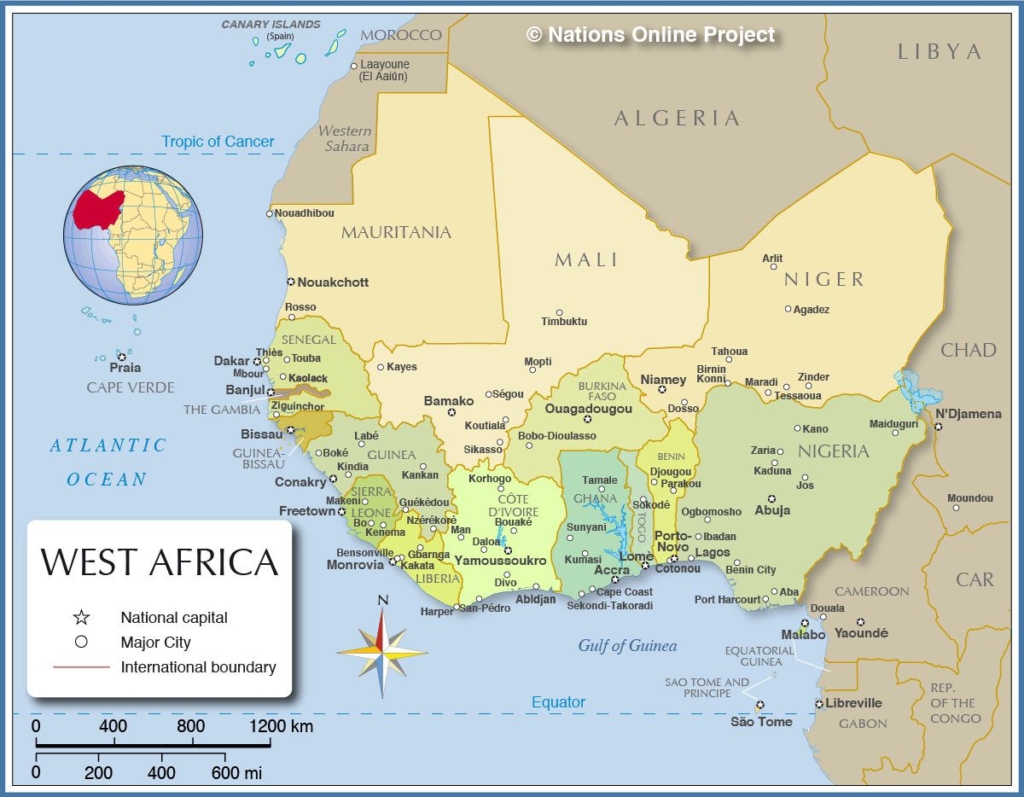

Sustainable Energy in West Africa

Sustainable Energy in West Africa

The Family continued their investment interests in real estate investments in Portugal and started to diversify into energy transition and sustainability thus taking the focus into investments in West Africa.

Family Office in London

Family Office in London

Moving back from West Africa, the Family moved to London and opened the UCEA Family Office where, through many differentiated relationships they made the decision to diversify further, so moving from real estate and energy, into sports, healthcare and tech.

Residential Units in Portugal and Spain

Residential Units in Portugal and Spain

Residential Units – Bobadela Cascais

At the moment, the family continues to develop small to medium size projects in Portugal, including recently the residential units near Bobadela, Cascais and exploring partnerships with the Commercial Projects in the Nova Science Faculty in Caparica with 10,000 sq meters of land that develop until the river side.

Lisbon University Project

Lisbon University Project

Project University Lisbon, Commercial Portugal

Expansion into Energy, Healthcare, Sports and Tech

Expansion into Energy, Healthcare, Sports and Tech

The family is now expanding their operations/investments significantly from traditional property investments into Energy, Healthcare, Sports and Tech with tickets sizes from 100k up to £3M and supporting companies from pre-seed stage until series A/B rounds.